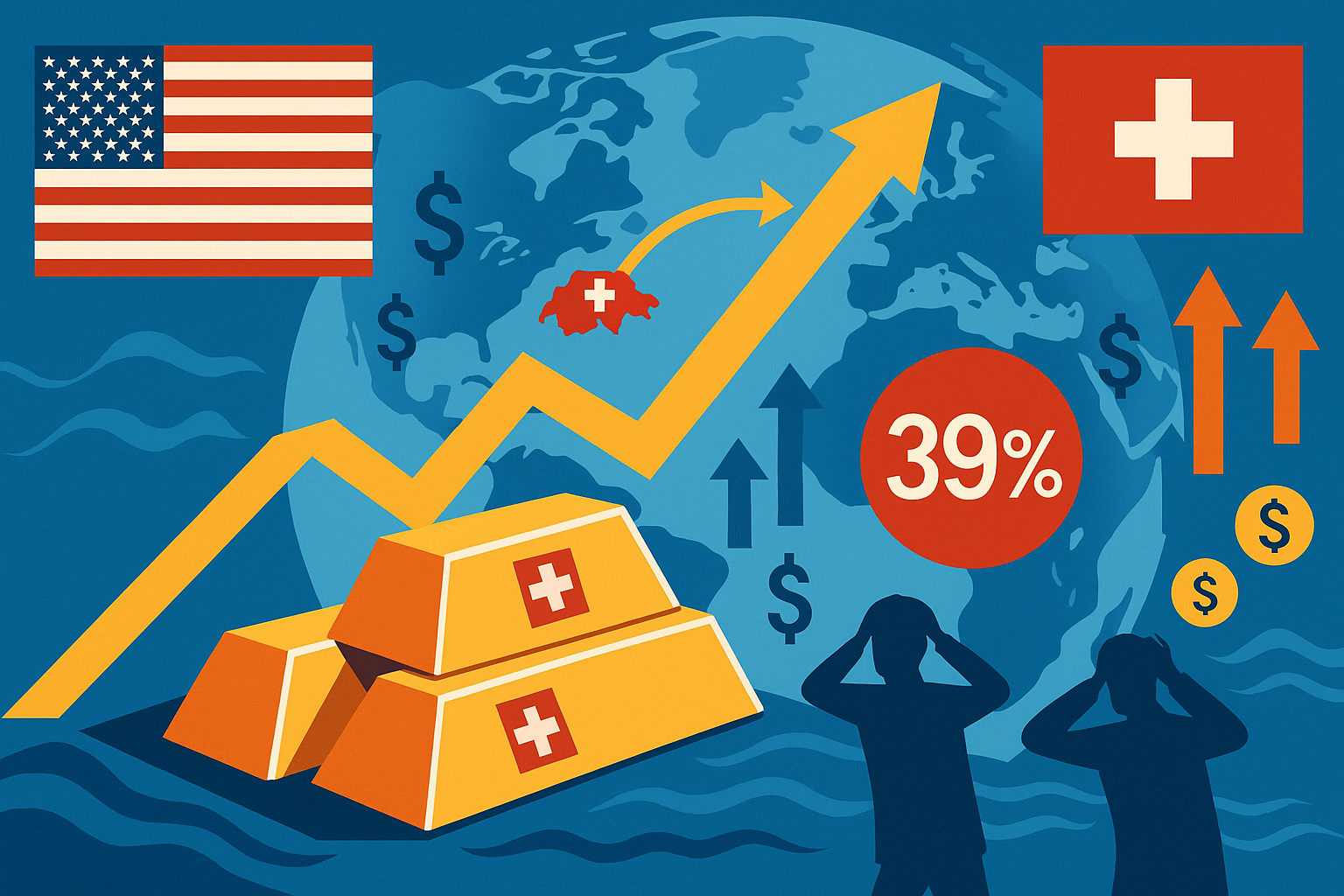

39% Swiss Gold Tariff Sends Futures Prices Soaring to Record Highs – Trade Policy Shockwaves Rock Global Markets

Introduction

August 2025 brought unprecedented turbulence to global financial markets. The United States announced the implementation of a 39% tariff on Swiss imports effective August 7th, with the shocking revelation that 1-kilogram and 100-ounce gold bars would be subject to these duties. This unexpected development sent gold futures prices rocketing past $3,500 per troy ounce to record highs, creating massive disruption across international gold markets.

Details and Timeline of the Tariff Announcement

Unexpected Customs Ruling

A July 31st letter from U.S. Customs and Border Protection (CBP) clarified that gold bars imported from Switzerland would be subject to reciprocal tariffs. This ruling came as a complete surprise to financial markets, as the industry had widely expected 1-kilogram gold bars to be exempt from “Trump tariffs.” These bars are the most frequently traded on Comex, the world’s largest gold futures market, and account for the majority of Swiss gold bar exports to the U.S.

Impact on Swiss Gold Industry

Switzerland processes approximately 70% of the world’s gold refining industry, making this tariff measure potentially devastating for the country’s economy. Swiss gold exports to the United States totaled around $61.5 billion in the 12 months ending in June, meaning the 39% tariff would impose an additional burden of approximately $24 billion.

Immediate Market Impact

Surge to Record Highs

When news of the tariff broke, New York gold futures prices surged more than 1%, reaching a record high above $3,500 per troy ounce. Gold has already risen 31% this year as investors seek safe havens amid trade and geopolitical turmoil.

Supply Chain Disruption Concerns

Gold bullion backs financial contracts traded on the Comex exchange based in New York, with these gold bars widely imported from Switzerland. The tariff introduction threatens to throw a costly wrench into global supply chains that flow between hubs in London, New York, and Swiss cities.

White House Response and Market Correction

Claims of “Misinformation”

However, the situation took a dramatic turn. White House officials called potential tariffs on gold “misinformation” on Friday afternoon and announced they would clarify the issue. “The White House intends to issue an executive order in the near future clarifying misinformation about the tariffing of gold bars and other specialty products,” an official statement declared.

Price Reversal and Market Wait-and-See

Following this announcement, New York gold prices pared their 1% gains, trading up just 0.2% by Friday afternoon. “The market is waiting for more clarity,” said Rob Haworth, senior investment strategy director at US Bank’s Asset Management Group. “I think this is a market with significant questions about is this really what was intended?”

Industry Response and Concerns

Swiss Refining Industry Reaction

Major Swiss gold refineries reportedly stopped deliveries to the U.S. after seeing the CBP ruling. Christoph Wild, president of the Swiss Precious Metals Dealers and Processors Association, expressed concern that the tariff decision would deal “another blow” to Swiss gold trading with the U.S.

International Gold Trade Implications

UBS strategist Joni Teves noted, “The tariff adds costs to this process, and with the bulk of refining capacity sitting in Switzerland which faces 39% US tariffs, these costs would be quite high.” She added, “There is still a lot of uncertainty around all this and until there is clarity, we expect the gold market and precious metals markets more generally to remain very nervous.”

Broader Economic and Political Context

Trump Administration Tariff Policy

President Donald Trump’s tariff campaign includes the 39% tariff on imports from Switzerland implemented on August 7th, among the highest rates imposed by the administration. This policy is positioned as part of a broader “reciprocal tariff” strategy.

Potential Impact on Swiss Economy

Adrian Prettejohn, Europe economist at Capital Economics, analyzed that a 39% tariff rate could knock around 0.6% off Switzerland’s GDP, or more with the inclusion of pharmaceuticals. However, he expects it to be negotiated down ultimately.

Future Outlook and Market Implications

Continued Uncertainty

“Likely imposing 39% tariffs on Swiss kilobars is akin to pouring sand into an otherwise well-functioning engine. I say ‘likely’…the possibility remains that this is an error,” said independent analyst Ross Norman.

Implications for Investors

This series of events provides important lessons for gold investors:

- Policy Uncertainty: Government policy changes can immediately impact markets

- Supply Chain Risk: The importance of geopolitical risks in global commodity markets

- Information Scrutiny: Gaps can emerge between initial reporting and final policy implementation

Conclusion

Gold, as a safe haven during uncertainty, has soared 31% this year as investors seek places to park their cash amid trade and geopolitical turmoil. The Swiss gold tariff saga vividly demonstrates how sensitive modern gold markets are to policy announcements.

While the White House has dismissed tariff application as “misinformation,” this incident highlights the structural vulnerabilities of gold markets and the potential magnitude of international trade policy impacts on precious metals markets. Investors must continue to carefully monitor policy developments and prepare for such sudden market volatility.

Currently, the White House’s forthcoming executive order is expected to “hopefully clear things up,” but as long as trade policy uncertainty persists, gold market volatility is likely to continue.

This article is based on information available as of August 9, 2025, and the situation may change rapidly. We recommend checking the latest information when making investment decisions.

References and Sources

- CNN Business – “Gold prices are on a rollercoaster after a curious tariff ruling that the White House called ‘misinformation'” (August 8, 2025)

https://www.cnn.com/2025/08/08/business/us-gold-market-switzerland-tariff-trump - Bloomberg – “Gold Bars Hit By Surprise US Tariffs, Unleashing New Turmoil in Market” (August 8, 2025)

https://www.bloomberg.com/news/articles/2025-08-08/us-hits-gold-bars-with-tariffs-in-blow-to-switzerland-ft-report - Finews – “Trump’s Tariffs Do Not Stop at Gold Bars” (August 8, 2025)

https://www.finews.com/news/english-news/68765-gold-zoelle-usa-barren-schweiz-affinerien-schmelze-finanzplatz-schweiz-2 - Euronews – “Gold futures rise after report Trump has placed tariffs on gold bars” (August 8, 2025)

https://www.euronews.com/business/2025/08/08/gold-futures-rise-after-report-trump-has-placed-tariffs-on-gold-bars - CNBC – “Switzerland’s tariff shock: The 39% U.S. hit no one saw coming” (August 1, 2025)

https://www.cnbc.com/2025/08/01/switzerland-economic-blow-with-surprise-39percent-us-tariff.html - CNBC – “Gold futures trade off highs as White House to issue clarification on bullion tariffs” (August 8, 2025)

https://www.cnbc.com/2025/08/08/gold-futures-trade-off-highs-as-white-house-to-issue-clarification-on-bullion-tariffs.html - Kitco News – “Shock U.S. tariffs on Swiss gold bars send gold price rocketing through $3,400/oz” (August 7, 2025)

https://www.kitco.com/news/article/2025-08-07/shock-us-tariffs-swiss-gold-bars-send-gold-price-rocketing-through-3400oz - Reuters via Kitco News – “White House to clarify tariffs for gold bars as industry stops flying bullion to US” (August 8, 2025)

https://www.kitco.com/news/off-the-wire/2025-08-08/white-house-clarify-tariffs-gold-bars-industry-stops-flying-bullion-us - Ainvest – “Gold Price Surges Amid 39% Tariff on Swiss Imports Impacting U.S. Futures Market” (August 8, 2025)

https://www.ainvest.com/news/gold-price-surges-39-tariff-swiss-imports-impacting-futures-market-2508/ - Axios – “White House planning executive order to clarify status of gold bars” (August 8, 2025)

https://www.axios.com/2025/08/08/gold-trump-tariffs